The Impact of CEX Gatekeeping on Crypto Accessibility

A Critical Discussion on Current Challenges & Future Developments

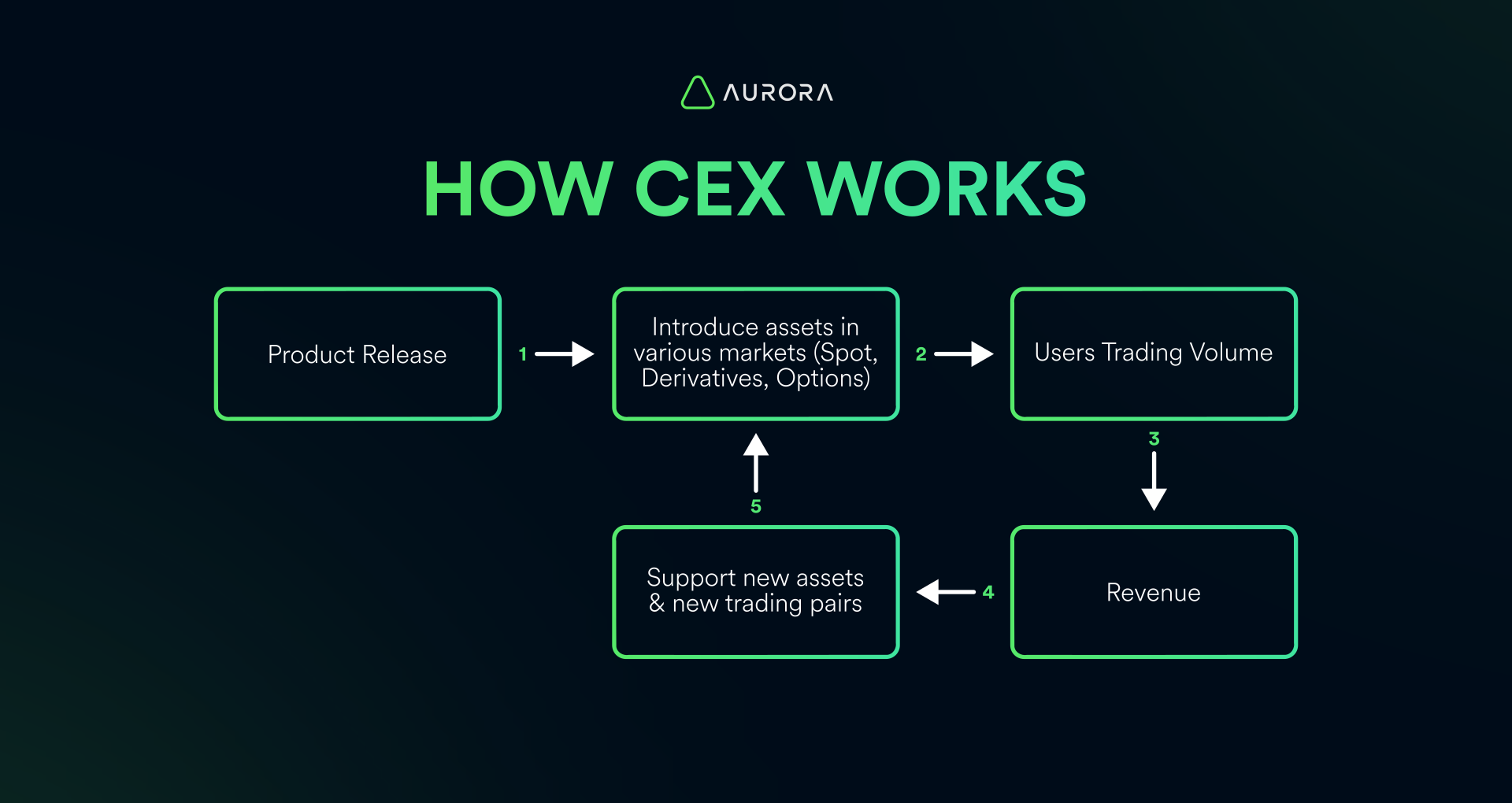

In the world of cryptocurrency, centralized exchanges (CEXs) play a crucial role in determining which digital currencies are readily available to the public. These platforms act as gatekeepers, with their listing decisions and chain integrations significantly influencing the overall accessibility of cryptocurrencies. Despite the emergence of decentralized exchanges (DEXs), CEXs continue to dominate the market due to their user-friendly interfaces, higher liquidity, perceived security, and on/off ramp solutions. This article aims to provide an exploration of CEX gatekeeping, its implications for crypto accessibility, and the evolving landscape of digital currency exchanges.

The cryptocurrency market has seen exponential growth, with thousands of digital currencies competing for attention. However, not all cryptocurrencies enjoy the same level of accessibility or visibility. This discrepancy is due, in part, to the gatekeeping practices of centralized exchanges, that determine which cryptocurrencies get listed and which do not. With over 10,000 cryptocurrencies in existence and the market capitalization of the entire sector reaching into the trillions of dollars, the power wielded by CEXs in shaping market dynamics cannot be understated.

Centralized exchanges play a crucial role in bridging the gap between traditional fiat money and the world of digital assets, significantly impacting cryptocurrency adoption and market liquidity. The methods and standards these exchanges employ in deciding which cryptocurrencies to list are vital for the success and reach of various digital currencies. However, with the constant influx of new cryptocurrencies, we're faced with pressing questions: Can CEXs keep up with the rapid growth of digital currencies? How will they maintain a balance between offering a diverse range of cryptocurrencies to attract and retain users and adhering to strict regulatory and security measures? And, might we see new strategies developed to tackle these challenges? These questions are complex and require a deep dive into CEXs' current listing practices to understand their benefits and limitations before we can attempt to find answers.

Understanding CEXs Gatekeeping

Gatekeeping in the context of CEXs involves a rigorous evaluation process where exchanges assess potential listings against a set of criteria. The processes are generally not fully transparent or open to the public. While many CEXs publish general guidelines and criteria for listing new cryptocurrencies, the detailed evaluation processes, discussions, and decision-making aspects are typically kept confidential. Some of the reasons to keep some information on their listing practices confidential might be to retain competitive advantage, retain their flexibility in negotiations and potentially, to prevent market manipulation by bad actors.

The lack of clear information about how CEXs decide which cryptocurrencies to list is a common worry among those who develop crypto projects and others active in the crypto world. This opacity is the cause of confusion about what is needed to get a cryptocurrency listed and why some are accepted while others are rejected. Therefore, the criteria mentioned below are just a basic set of requirements for projects to potentially qualify for listing. But meeting these requirements doesn't guarantee that a new blockchain will be listed, there might be additional factors at play in the decision-making process.

Regulatory Compliance: Ensuring the cryptocurrency adheres to legal standards in jurisdictions where the exchange operates. Security: Evaluating the project's security measures to protect investors and users from hacks and fraud. Market Demand: Assessing whether there is sufficient interest in the cryptocurrency to justify its listing. Innovation and Utility: Considering whether the cryptocurrency offers unique features or technological advancements. Community Support: The presence of a strong, active community can be indicative of the cryptocurrency's long-term viability.

The Dual Impact of CEX Gatekeeping

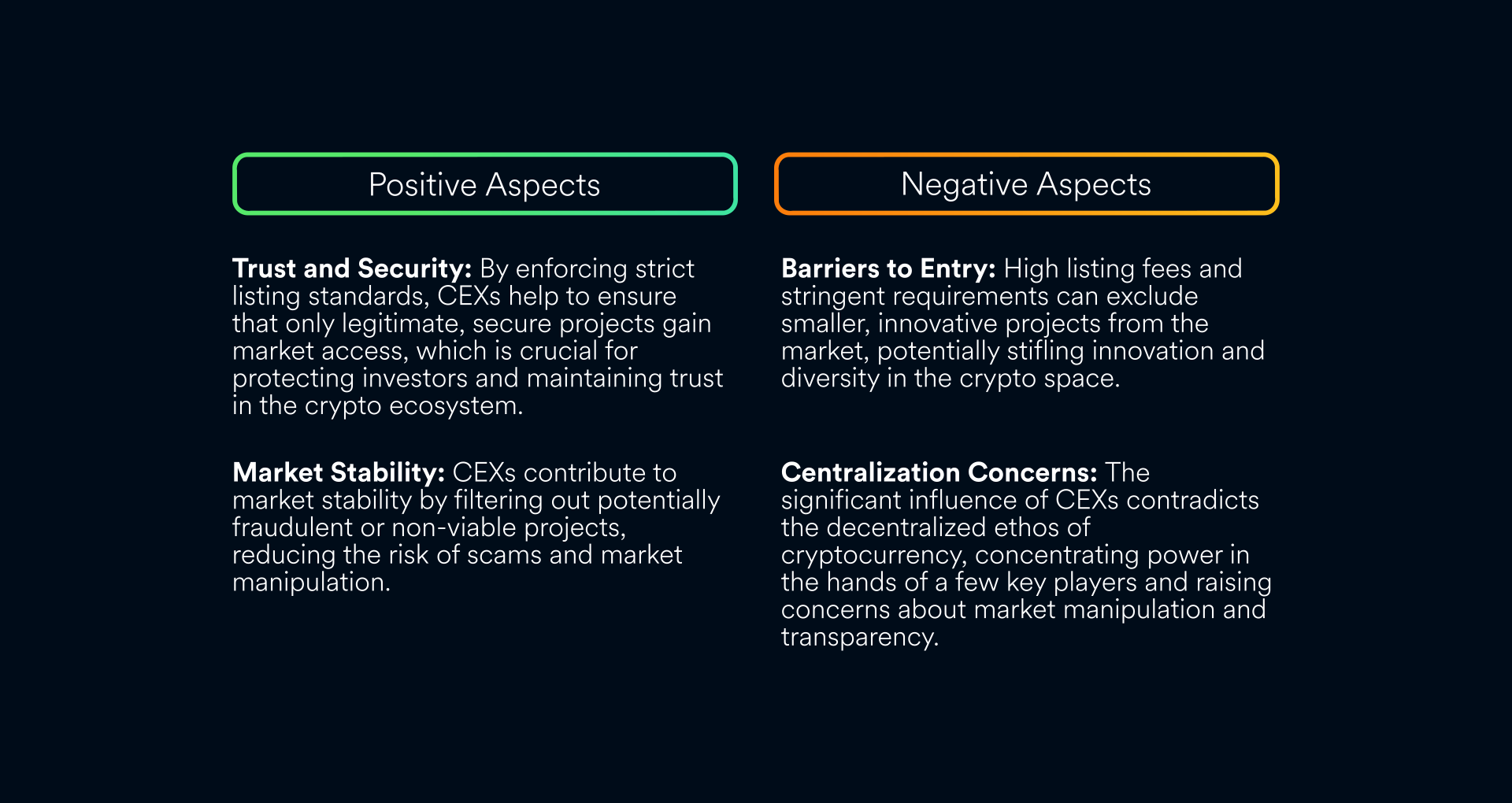

As discussed above, the process of gatekeeping by CEXs has a profound impact on the cryptocurrency ecosystem, wielding both positive and negative influences. As gatekeepers, CEXs determine which cryptocurrencies can enter the market based on a set of criteria aimed at evaluating the project's viability, security, and potential for success. This selection process is not without its consequences, shaping the landscape of the crypto world in significant ways.

Are DEXs a Solution?

Decentralized exchanges (DEXs) offer a counterpoint to CEX gatekeeping by allowing for permissionless listings and direct peer-to-peer transactions. By enabling permissionless listings and facilitating direct transactions between peers, DEXs advocate for a market driven by community interest and participation. This approach contrasts sharply with the controlled, often opaque listing processes of CEXs, presenting a potential solution to some of the limitations imposed by centralized gatekeeping.

Currently, centralized and decentralized exchanges have found their own niches within the cryptocurrency ecosystem, catering to the varying preferences and needs of users. However, it's evident that the challenges associated with DEXs—such as their lower liquidity, the complexity of user interfaces, the security concerns tied to permissionless listings, and the absence of direct fiat on-ramps and off-ramps—position DEXs more as an alternative or complementary option to CEXs rather than as a mainstream solution. Both play a unique role in the broader landscape of digital assets but DEXs’ distinct offering does not really make it a solution to avoid the challenges of CEXs.

What Does the Future Look Like?

The debate around CEXs evolution encapsulates the tension between the need for regulation and the push for a decentralized financial ecosystem. As the cryptocurrency market evolves, striking a balance that encourages innovation while ensuring safety is paramount. This balance may lead to the creation of new governance models for exchanges, improved regulatory frameworks, and the growth of decentralized finance (DeFi).

Looking ahead, we might anticipate a shift in the cryptocurrency ecosystem where the momentum towards decentralization gains unprecedented strength, challenging the dominance of centralized platforms. Although such a drastic change might seem distant, decentralized technology keeps on advancing at a formidable pace, and with institutional distrust and economic crises becoming more prevalent it is not unlikely to see a full embrace of decentralized financial options.

In the meantime, a more immediate and tangible development could be the emergence of technical solutions designed to enhance token accessibility within CEXs. One promising approach could be the integration of blockchain interoperability solutions, which would allow for seamless movement of assets across different platforms, thereby reducing the barriers to entry for new tokens and fostering a more inclusive market environment.

These are just speculations, but it is sure that a change is about to happen to face growing challenges of accessibility of new crypto projects. CEXs will have more pressure to address demands for greater inclusivity and accessibility, and possibly to further incorporate decentralized principles.vAs the sector matures, the dialogue between exchanges, regulators, and the broader crypto community will be instrumental in crafting an ecosystem that balances the benefits of centralized oversight with the freedoms of decentralization. Ultimately, the future of cryptocurrency accessibility hinges on our ability to innovate and adapt, carving out a path that ensures a robust, dynamic, and inclusive digital asset market for all participants.

About Aurora

Powered by its high-performance EVM, and fully trustless Rainbow Bridge, Aurora combines an Ethereum compatible experience with the modern blockchain performance of NEAR Protocol. Aurora provides an optimal environment for the creation of scalable, carbon-neutral, future-safe, and low-cost Web3 services, as well as the perfect tools to bring to life your Web3 initiatives. Try Aurora Cloud, our all-in-one blockchain solution for enterprises, and get your Web3 journey started!